Rethinking water and investing in the valley of death.

Why closing the investment gap in water matters more than ever. See you on NYC on 25th September!

I’ll be revisiting and repurposing top content from 2024—this time with context, commentary, and key takeaways.

Whether you’re catching up or rewatching, think of this as your curated highlight of the year that was.

In another concise but insight-packed episode in 2024, I had the pleasure of speaking with one of our most remarkable guests: Alexander Locopoulos from Sciens Water.

Money is essential, not just in our daily lives, but in the water industry too.

So I asked a tough question: What’s going wrong in water investment?

We dug into the reality that water innovation often takes 10–15 years to go from idea to commercial adoption.

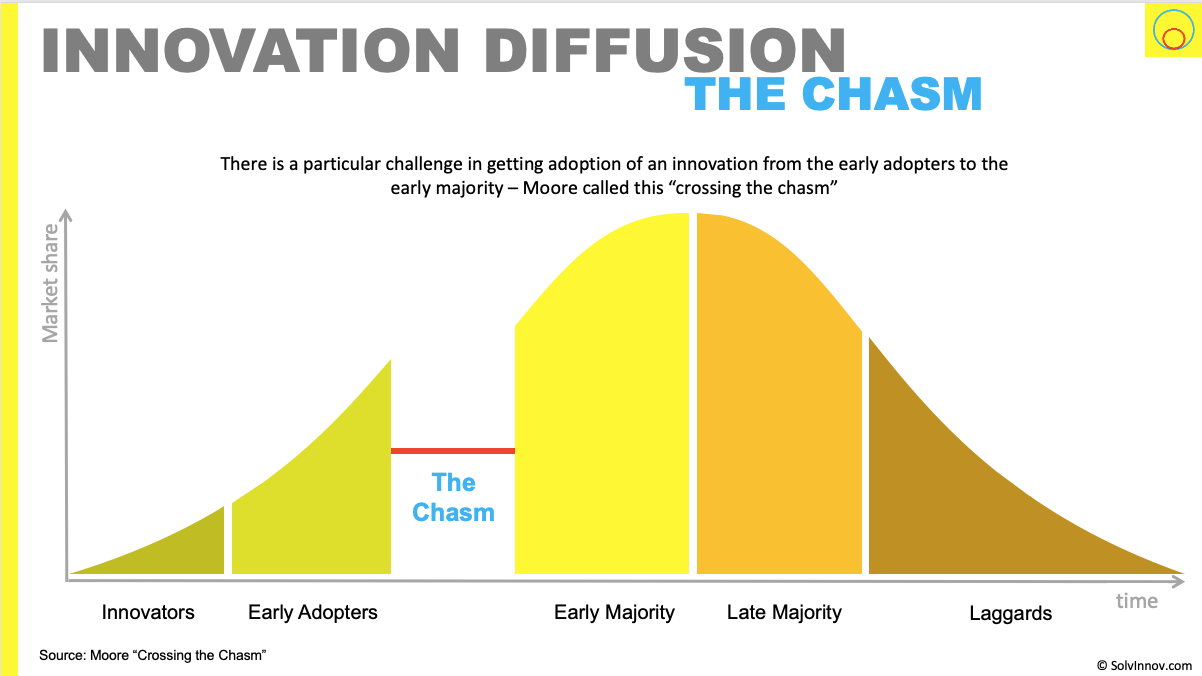

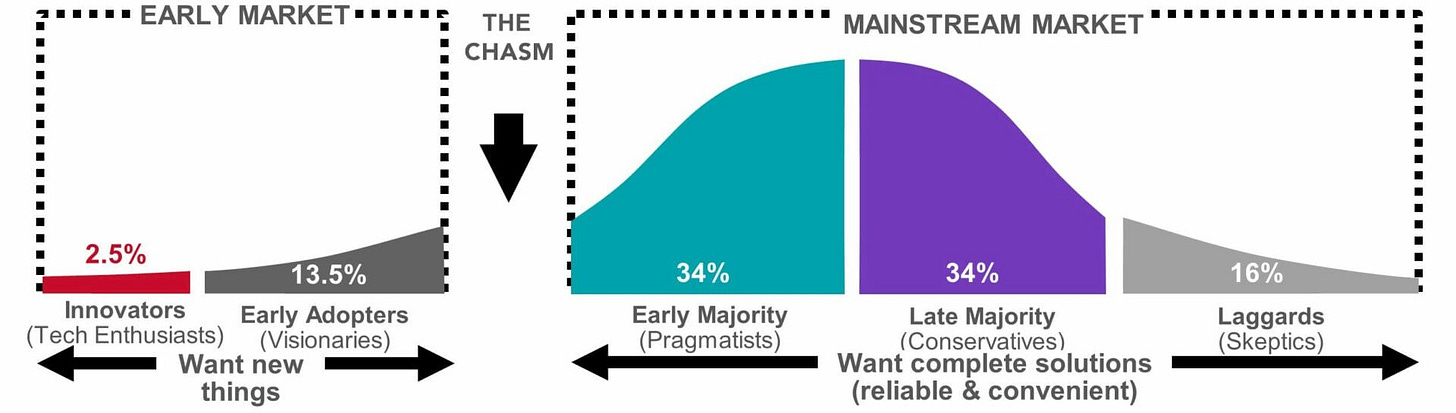

That stretch between early development and market traction? It’s what’s known as the Valley of Death, or the chasm.

That’s where firms like Sciens Water come in, investing in companies that are in that middle ground, the middle market, and helping them scale and sustain.

With Alex, we talked about this investment gap and why it’s so hard to fix.

The Good News?

Water is non-negotiable. It is an industry with very strong fundamentals.

Not so exposed to general economics issues. If there is another debt cycle crash in the next years, all will be affected, but water, I mean, this needs to keep flowing in one way or another.

Being mostly a regulated industry, it allows quite stable cash flows in the long-term.

You can’t ignore it, postpone it, or call it outdated.

The bigger the investment gap gets, the more pressure builds, sooner or later, capital has to flow, because water isn’t optional.

The Bad News?

We’re still slow at doing things better.

Talent often drifts to flashier industries, and we risk a huge talent gap as experienced professionals retire in the next decade, with few stepping in to replace them.

We need to communicate better, also within our industry.

Partnerships and collaborations must continue to keep creating value.

Our guest

Our guest is one of those individuals that most of us will likely never even come close to in our lifetimes.

Even if I were to reset my life and try to follow his path from the beginning, I don’t think I could replicate it.

That’s exactly why it’s so valuable to bring professionals like Alex into our community, so we can all gain some direction, insights, and inspiration within our industry.

To quote his background:

Mr. Loucopoulos is a partner with Sciens Capital where he has worked since 2005. He was a founding member of the firm’s real asset investing platform and for the last eight years he has been focused on building the firms dedicated water investment platform, Sciens Water. Mr. Loucopoulos has over fourteen years of establishing various real assets funds including water, aviation, maritime, coloured stones, energy infrastructure and real estate. Prior to Sciens, Mr. Loucopoulos was part of the founding team of UGO Networks and served as its Vice President of Corporate Development. Mr. Loucopoulos also worked as a consultant to Tony Fernandes, the CEO and founder of AirAsia, as well as for NBC in its broadcast of the 28th Olympiad. Mr. Loucopoulos began his career at JPMorgan as an Investment Banker specializing in Mergers and Acquisitions in Latin America. Mr. Loucopoulos received a cum laude B.S.F.S. from Georgetown University’s School of Foreign Service and an M.B.A. from the MIT-Sloan School of Management, where he was a Martin Trust fellow.

Mr. Loucopoulos sits on the corporate advisor boards of The Water Center at Columbia University, the Water Institute at the Julie Ann Wrigley Global Futures Laboratory at Arizona State University, as well as the Mississippi Towns and Rivers Initiative (MRCIT). He also sits on the scholarship committee for American Water Works Association and since 2006 has been the Manhattan Chair of Georgetown's AAP admission committee.

Why technologies die here

The Valley of Death is the gap between a validated concept and a viable commercial product. At this stage, the tech:

Needs significant investment, but...

Still carries high risk, and...

Lacks a clear customer or market fit.

Governments fund early research.

Investors fund “proven” products.

But few are willing to back something that’s too real for academia and too risky for business.

As a result, even game-changing ideas die here, not because they don’t work, but because they don’t get the support they need to survive.

Funding Gaps: Venture capital often avoids “hardware-heavy” or regulatory-constrained sectors like water. But we can find them, for instance PureTerra Ventures, Burnt Island Ventures,…

Long Timelines: Some technologies need 10–20 years to mature in water space. Most investors want returns in 2–3.

Lack of Industry Partnerships: Without commercial pull or pilot projects, startups can’t prove real-world value.

Regulatory Hurdles: Emerging tech often enters markets with slow approval processes and complex compliance needs.

Talent Drain: Founders and teams burn out or pivot before the tech reaches market readiness.

All of these points are clearly explained in Paul O’Callaghan Book, that again I advise you to get one because it gives you a clear insight into this journey.

Here below another examples of innovation curves, so you may understand where and why is the need to bridge the gap in the innovation curve.

Is any part of the curve more appealing to investors?

Investment happens all along the innovation curve, through different approaches.

Investment firms position themselves at various points on this curve.

For instance, in our episode with Skion Water, our guest Dirk spoke about some of the setbacks they faced when they initially invested in water technologies at a very early stage.

After those experiences, they decided to shift their focus toward the Early Majority stage of the curve, where technologies are already more mature, with proven operations and active clients.

On the other hand, if you look at firms like PureTerra Ventures or Burnt Island Ventures, they tend to focus on the early stage of the curve.

So while I don't yet have a complete picture of all players and their positioning, it is one of our goals to find out more about this part of the business and share with all of you during next years.

Let me give you an example

How would you consider the technology of deep-sea desalination?

It's clearly still in the early stage of the curve.

Companies like OceanWell, Flocean, and Waterise are actively developing submerged desalination systems at depths around 400 meters.

These systems use natural ocean pressure to power reverse osmosis (RO), reducing energy consumption by 30–40% and minimizing environmental impact.

Next season, we’ll have the honor of welcoming OceanWell to our platform, where they’ll share more details about this promising technology and where it’s heading.

These systems are currently in pilot and demonstration phases, with plans to scale to commercial use in the coming years (moving further along the innovation curve toward the mainstream market).

That means these companies will require additional rounds of investment.

Rethinking Water Conference 2025

The Rethinking Water Conference, held in New York City, is a landmark event organized by Sciens Water in collaboration with Columbia University and other key partners.

The conference brings together leaders from across sectors to address one of the most urgent global challenges: the future of water.

academia

public policy

investment

utilities

technology

engineering

ethics

The main purpose of the event is to create a platform for interdisciplinary collaboration and innovative thinking.

It aims to bridge gaps between theory and practice, connecting academic research with real-world implementation (this is so important…), and aligning policy frameworks with technological advancements and private sector investment.

One of the key themes is understanding water as a complex, interconnected puzzle, where infrastructure, governance, climate adaptation, and community impact must be tackled together rather than in isolation.

The conference fosters deep dialogue on how to rethink not only the management of water resources, but also the business models and regulatory structures that support long-term resilience and equity.

I want to thank Alexander for inviting me to attend in-person, so I confirm my presence on 25th September. If any of you are reading these words and attending too, drop me a message so we can meet!

I think the timing is perfect to understand the dynamics of this event, the US challenges and how our community can contribute to improve the puzzle.

Watch the trailer of the event in the next link:

If you're short on time, I’m linking one of the most inspiring talks from that event, from John Rigas, CEO of Sciens Water. It’s well worth a watch.

What do I expect from this event?

This event gains more traction every year, and I expect to find myself as the least intelligent person in the room, which, honestly, might be exactly what I need to spark new inspiration.

One of my goals is to create an official Water MBA, both digital and in-person.

The aim is to offer a structured learning framework that gives water professionals the educational boost they need to keep adding value to our industry.

With that in mind, I’ll bring my phone and microphone to capture insights from attendees during the event. I plan to ask questions like:

What would you expect from a Water MBA?

What topics should it cover?

Which institutions or programs can be our reference in how they transmit the knowledge (e.g., Columbia, Georgetown)?

Why did you come to this event? What are you hoping to find or achieve?

How do you envision the near future of our industry?

Hopefully, these conversations will help shape a clearer vision and maybe even spark some partnerships to build new ideas and reach wider audiences.

Since the main stage will likely be streamed online, I’ll focus more on the behind-the-scenes dynamics, the inner circles, breakout sessions, and side rooms that aren't broadcasted but often hold the richest interactions.

I'll be documenting the entire trip and key insights in a dedicated vlog episode, which will be published shortly after the event.

The Water Center at Columbia University

The Center is a research and policy hub dedicated to addressing pressing water challenges through data-driven solutions, interdisciplinary research, and community-focused engagement.

It brings together scientists, engineers, economists, and urban planners to develop sustainable strategies for water use, especially in vulnerable and underserved communities.

Founded with a mission to ensure equitable access to clean water, the Center tackles everything from aging water infrastructure in American cities to climate resilience in coastal zones.

Its projects include:

Urban water system modeling

Flood and stormwater management

Policy advising on lead and PFAS contamination

Training future water leaders through fellowships and partnerships

Take a look at its website to find out more.

Rethinking Water in UK!

If you're not planning to move to the U.S., at least keep on your radar that the first edition is now being launched in the UK, I think it's going to be truly awesome!

Not only water tech, but also infrastructure

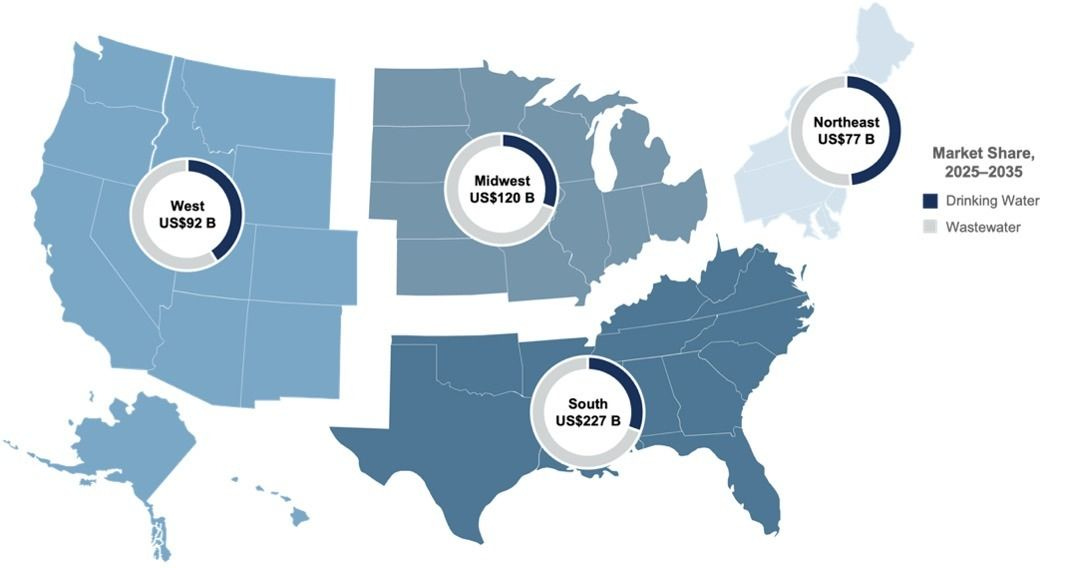

I recently came across an interesting post by Carlos Cosin, which I quote below.

The main point I want you to take away is this: we need to understand how to make money work in our industry, how to improve investment efficiency and avoid situations where we say, “Okay, let’s regulate and progress. I have the technology ready, but what’s the business model? Who pays for it? Who’s funding it? What’s the return?”

“US$515 Billion by 2035 — that’s the projected capital expenditure for water and wastewater treatment infrastructure in the U.S., according to the latest Bluefield Research report: https://lnkd.in/dZ44FTN6. A staggering figure, but one that reflects the scale of the challenge ahead.

Aging infrastructure, tightening regulations, climate stress, and demographic shifts are pushing utilities to rethink their long-term strategies. Yet 80% of this spending will go toward rehabilitation, not new systems. This tells us something important: the problem isn't lack of awareness; it's the inertia of outdated models.

One key takeaway: there’s a growing gap between infrastructure needs and financing flows. And public funds alone won’t be enough to close it.

To truly modernize water infrastructure, we need:

🔹A bold commitment to long-term planning

🔹Scalable and decentralized technology

🔹And, above all, a greater role for private companies, bringing capital, innovation, and execution capacity to the table.

The U.S. is not alone in facing these pressures. This is a global call to action. Deferring investment is no longer an option.”

Let’s learn more about investment in infrastructure

In the coming days, I’ll be uploading a video featuring a business case on ACWA Power, offering you a first look into how infrastructure projects, especially in the water sector, can be structured through public-private partnerships (PPPs).

This case will introduce you to key models such as BOT (Build-Operate-Transfer) and BOOT (Build-Own-Operate-Transfer), and highlight the main stakeholders involved: offtaker, lenders, investors, sponsors, SPVs (Project Company), EPC contractors, and O&M operators.

It's a first step, as next season we’ll take a deeper dive into building a business financial model, analyzing Capex, Opex, and the essential cost drivers to consider when calculating water tariffs, whether for standalone water projects or integrated solutions combining water and renewable energy.

Get ready to explore the real mechanics behind infrastructure.

We’re opening the opportunity to include brief sponsorships at the beginning of our articles.

This helps us reinvest any revenue into new features, platform upgrades, and more learning opportunities for our growing community.

If you're interested or want more information → Be Our Sponsor