What makes Chile’s water story so fascinating?

Summarizing a nation that stands out in our community for its water story.

I’ll be revisiting and repurposing top content from 2024, this time with context, commentary, and key takeaways.

Whether you’re catching up or rewatching, think of this as your curated highlight of the year that was.

Chile is our main source of members in LATAM, which makes sense given we have three amazing episodes featuring Chilean experts: #5 with Carlos Goitia from Aguas Nuevas, #58 with Alberto Kresse from ACADES and #64 with Carlos Rubilar.

Here’s a summary of key points to keep in mind about Chile, especially since episode #5 ranks among our top-viewed episodes.

In 2024, I sat down with Carlos Goitia from Aguas Nuevas, and the response was huge, thousands of views and strong engagement, especially from the short clips we shared on social media.

The topic?

Chile and Desalination, a country with a fascinating and complex water story.

Chile is a land of extremes: extreme drought in the north, water surplus in the south, and a long, resource-rich coastline in between.

Over the past 60 years, its population has doubled, but projections show it stabilizing going forward.

And in terms of industry, it is well above—especially in mining.

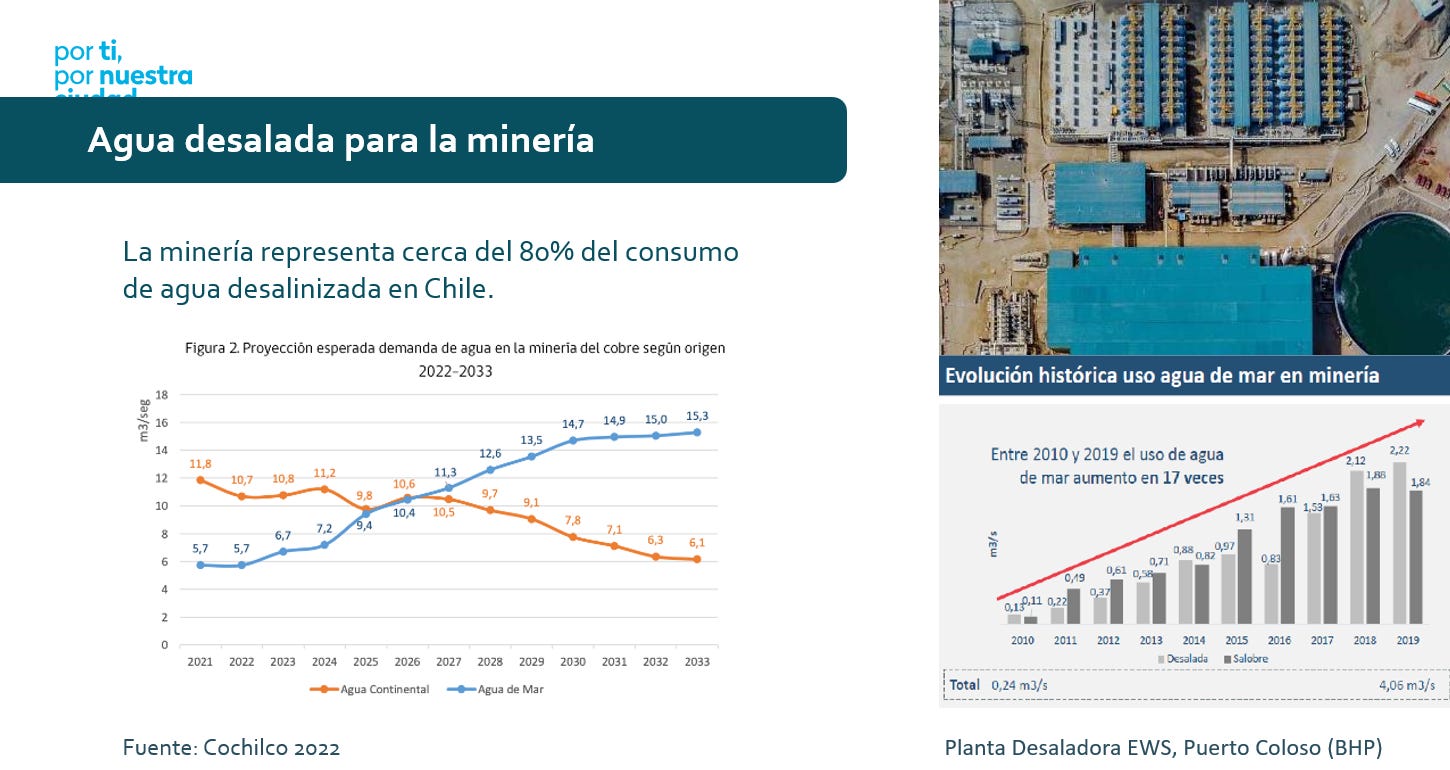

Mining industry has progressively increased their water demand from conventional resources to seawater resources, multiplying x17 times the use of seawater from 2010 to 2019, and the forecast is expecting to keep growing up to 2033 as shown in the bottom left graph.

The country also has massive renewable energy potential, with large-scale solar and wind projects already in motion.

These aren't just for powering homes, they’re laying the foundation for green hydrogen, a industry that depends on the right mix of renewables and water (as explained in our episodes at The Water MBA TV).

But here’s the catch: Chile is not an easy place to build water projects.

Permitting is complex, and timelines can drag.

There's a high level of environmental awareness, which is great in principle, but often adds layers of delay and complication for developers and innovators.

Still, desalination is growing, particularly to meet the needs of the mining sector.

Chile is home to some of the most recognized desal plants in Latin America.

But public perception of brine discharge remains a sensitive issue, one that Carlos broke down brilliantly in the episode, with a scale comparison with a soccer pitch.

If you're a water professional trying to understand the global water markets, you can’t ignore Chile.

Water stress and geographic context

Chile is identified as being under high water stress, ranking 16th among many countries.

It is a long and narrow strip of land, stretching over 4,000 km along the Pacific Ocean coast, with all major cities located within 200 km of the coastline.

The country has faced constant water stress since 2007, particularly in the northern and central regions.

More than 60% of Chile's surface area and over 70% of its population are habitually under this water stress.

Desalination role summary

Desalination is a key response to Chile's water scarcity, predominantly in the northern part of the country.

The majority of desalination development has been driven by private initiatives for the mining industry.

Antofagasta Region is a leader, where desalination plants supply 100% of the potable water for the population.

Desalination for potable water is still incipient, accounting for only 1.5% of the national potable water supply, mainly in the Atacama and Copiapó regions.

Future Projections: Desalinated water for mining processes is expected to double by 2034.

Main barriers and challenges

A significant barrier for potable water supply, as Chile's water tariffs are designed to recover the total cost of infrastructure.

There are existing barriers related to environmental permits for seawater extraction and land use.

Desalinated water is currently used very little for agriculture, despite being the main consumer. Traditional gravity-fed irrigation remains widespread.

Opportunities

Seawater is seen as a viable alternative to address water scarcity.

Chile promotes private investment and public-private collaboration projects, including multi-purpose plants that benefit from economies of scale and better utilization of coastal areas.

A new regulatory framework is under legislative discussion to establish a national desalination strategy and introduce concessions for desalination that will define specific rights and obligations. This framework also seeks to order and plan public desalination plants across various regions.

There is a recognized need for a deeper analysis of the regulatory framework for potable water tariffs to ensure cost recovery and to work more intensely on subsidizing potable water based on demand, focusing on vulnerable populations.

The policy aims for a gradual integration of desalination costs into tariffs and to avoid a fragmented approach where each sector solves its own problem, promoting integration across sectors, including agriculture in the future.

Chile follow-up

Our community will continue to closely follow any relevant updates on Chile’s water business. I feel we’ve covered a lot in our first season, especially with episodes #5, #58 and #64 so I hope we can shine a light on other Latin American countries from which we can learn.

If you’re working on water issues in Chile and believe there’s a message, case study, or innovation worth sharing with our audience, please drop me a message.