Water footprint offset mechanisms.

The intersections of water, business, and sustainability.

I’ll be revisiting and repurposing top content from 2024—this time with context, commentary, and key takeaways.

Whether you’re catching up or rewatching, think of this as your curated highlight of the year that was.

I have to confess, this is one of my favorite episodes, and I’m sure many who watched it on our TV channel feel the same.

Our guest, Marcos de la Monja, carried about 80% of the magic, with extraordinary communication skills and presence. But the topics themselves were equally important.

On one side, we discussed:

Water Positive

Industrial Wastewater Treatment

Regarding industrial wastewater treatment, I find it a fascinating field.

No matter how many case studies you explore, there is an entire world of industries, each with its own particularities.

We learnt the concept of Waste Water as a Service, you will have noticed that this business model is increasingly having more presence worldwide and at international forums.

Please note that Marcos has greatly benefited from his contribution to The Water MBA :D (just kidding). He is no longer COO at BioDAF and has taken on a new role as Senior Water Strategy Manager at Amazon Web Services.

He is a clear example of the kind of professional we want in our community—multidisciplinary, forward-thinking, and impactful.

Marcos could become one of our key references in the future, especially to share insights on topics like water and data centers. I’m very curious to learn more about this!

As for Water Positive, it’s impossible not to notice the buzz, whether you’re on LinkedIn or attending any international water event.

I wanted to dig deeper: What exactly is it? How does it move from talk to real action? What’s the story behind it?

This article is my attempt to dive a bit deeper into the concept.

I believe it’s an extraordinary example of how people, and businesses, can leverage new regulatory frameworks to create a genuine positive impact on water.

To be honest, at the beginning I wasn’t fully clear about it. Is this a new carbon credit–type market? Is it officially recognized? Is it a think tank? Just a divulgation effort? Or maybe a business opportunity?

I also wondered: Did it start with one individual’s idea, or was it something sparked by the decisions of big companies?

I want to share all my insights here because, as with any good story, this one has many angles, and perhaps a little bit of everything.

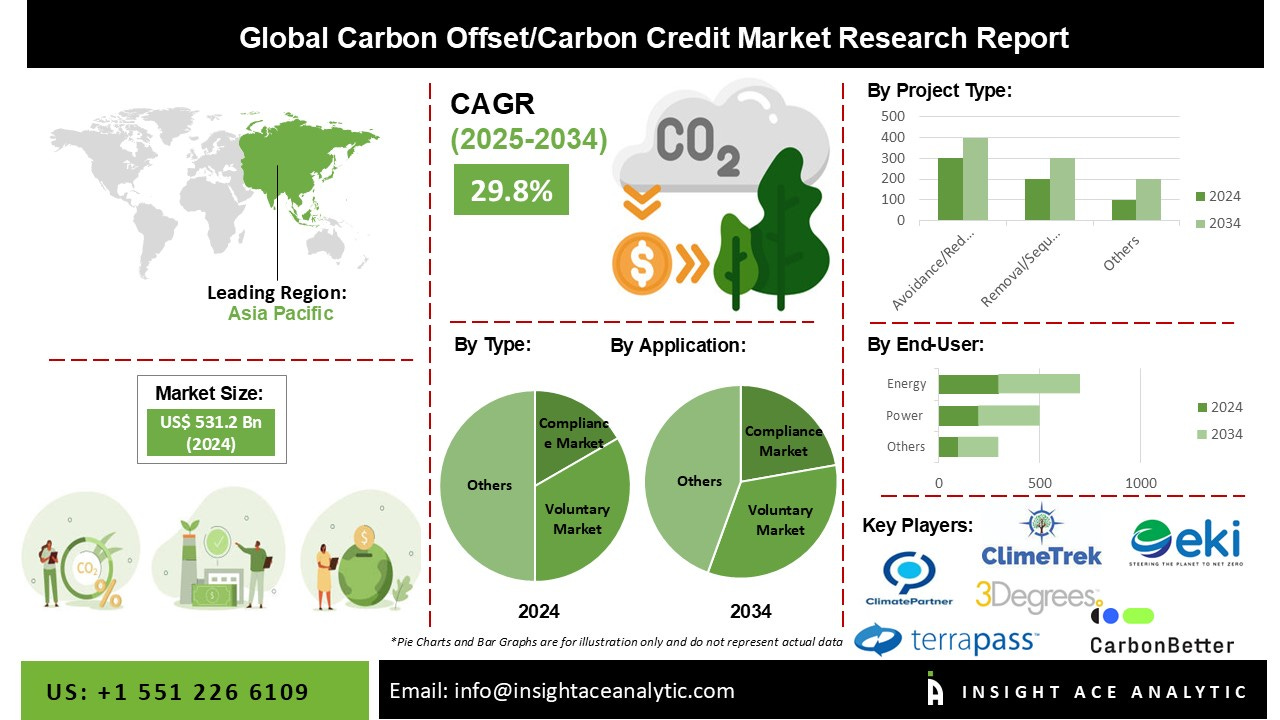

First, let’s understand the carbon.

In the world of sustainability, carbon has long taken center stage.

Carbon credit markets are well established, global protocols are in place, and companies are racing toward net-zero targets.

So now, the water credit market?

A growing response to a global challenge: how do we value, manage, and equitably distribute one of our most critical resources?

Carbon credits are part of a market-based mechanism to reduce greenhouse gas (GHG) emissions.

Here’s how it works in simple terms, please pay attention:

1 carbon credit = 1 tonne of CO₂ (or equivalent GHG) reduced or removed

Companies buy credits to offset (this word is very important) their emissions, either voluntarily or to comply with regulations.

These credits fund projects like reforestation, renewable energy, or methane capture.

The goal is to internalize the environmental cost of carbon emissions and financially incentivize emission reductions across industries.

Over the last two decades, carbon credit markets have matured significantly, with both compliance markets (like the EU ETS) and voluntary markets (like Verra or Gold Standard) guiding their growth.

Water credits (let’s call it this way, as I said I am not sure about official wording) aim to do for water what carbon credits did for GHG emissions, create an economic mechanism to value stewardship.

The next quote is something you need to retain in your mind, so you can understand one of the unique characteristics of our business:

Unlike carbon, however, water is local, variable, and deeply contextual. There’s no “global water problem”, there are thousands of local water crises, each with different needs.

Water credits are still emerging, but typically function in one of two ways:

Water Restoration Credits (WRCs):

These represent a verified volume of water returned to nature or restored to a watershed (e.g., through wetland restoration, leak reduction, or stormwater capture).Water Quality Credits (or nutrient trading):

These allow entities to offset their pollution by funding improvements elsewhere in the watershed, such as agricultural runoff reduction.

So far, water credit systems have been regional and pilot-based.

The U.S. and Australia have led early initiatives, but more are forming around basin-specific markets and corporate water stewardship programs.

Microsoft and the birth of "Water Positive"

In 2020, Microsoft made headlines by becoming the first major tech company to commit to being "water positive" by 2030.

This meant that Microsoft would:

Reduce water use intensity across operations

Replenish more water than it consumes in stressed basins

Support healthy watersheds through community and tech investment

Provide transparency through detailed water data reporting

This term "water positive" was a bold counterpart to "carbon negative", and inspired a new class of sustainability commitments.

Soon after, other companies, including Meta and Google, made similar announcements.

But again, as mentioned before, what made it different was the localized nature of the goal. Replenishment had to happen in the same watersheds where water was consumed, ensuring a net-positive local impact.

In 2023, the Water Positive Think Tank (WPTT) was founded by bringing together over a hundred professionals, growing rapidly from diverse disciplines and backgrounds. It creates a collaborative, inclusive, and scientifically driven space to think, analyze, and share knowledge about water stewardship.

Why water is more complex than carbon

For several reasons:

Water is not fungible like carbon: 1 liter in California ≠ 1 liter in India.

Water’s value is context-dependent: Drinking water, industrial use, and agricultural irrigation all place different pressures on systems.

Data is often lacking: Unlike global GHG emissions, water usage is poorly tracked in many regions.

Despite these challenges, interest is growing.

Water risk is now a board-level issue, especially for industries such as:

Food & beverage

Pharma

Semiconductor manufacturing

Textiles

Mining and energy

Companies are realizing that water is both an operational risk and a social responsibility, and water credit markets could become an essential tool.

Business opportunity

As an emerging business school, I particularly have a strong passion for business cases. The value of this type of content will continue to grow on our TV channel, Water Stories.

In this topic, let’s take a look at Aqua Positive, which has established a business model centered on helping organizations achieve "water positive" status and manage their water footprint comprehensively.

Here's how Aqua Positive makes a business:

It acts as a strategic water consultancy. They assist companies in understanding their water dependency across operations and supply chains, which aligns with the initial steps of water footprint measurement: objective and scope definition, and water footprint accounting.

They help organizations measure their water footprint and develop customized improvement plans to reduce it. This involves advising on maximizing efficiency ( reduce chemical consumption, water and energy savings…).

A key driver for their business is new legislation, particularly the Corporate Sustainability Reporting Directive (CSRD) in Europe.

This directive obligates tens of thousands of companies in the EU to report on their water consumption, impacts, risks, and opportunities across their entire value chain. Aqua Positive provides the necessary understanding and data for businesses to report accurately.

Water Benefit Project Development and Marketplace, where that unique "water positive" approach, which means giving more water back than is taken out, becomes a relevant business.

They identify, develop, and implement high-level projects that generate water benefits. These projects could involve producing new potable water from non-potable sources, such as through desalination and water reuse.

It creates a marketplace to connect companies seeking to compensate their water footprint (demand) with projects that generate these "volumetric water benefits" (supply). This allows a company that has reduced its water use as much as possible to compensate its residual water footprint by investing in projects that create new water or save water in the same stressed water basin.

They have launched a digital platform that serves as a bridge, allowing companies to easily find and "buy" water benefits from projects that correspond to their water footprint's location. This platform ensures transparency and traceability of data (useful for sustainability reporting).

From a business perspective, I feel this is an extraordinary, top-level business case. To be honest, I’m not surprised, knowing the caliber of the water professionals involved.

I believe these are the kinds of cases we should draw inspiration from, real initiatives that ultimately create value and improve water ecosystems.

It places water at the core of sustainability strategies.

How you measure water footprint

The water footprint measures the total volume of freshwater used to produce goods and services. Developed over two decades ago by Professor Arjen Hoekstra, it encompasses direct and indirect water use across supply chains.

If this article feels too brief (don’t think so), remember Mr, Arjen was co-author of the guidelines you can download here (more than 200 pages for some summer reading)

Our episode with Ioana Dobrescu aimed to open up the conversation. Although this topic has many nuances, here’s what we discussed:

Objective and Scope Definition: This initial step involves clearly defining the purpose of the water footprint assessment. For a business, this could include understanding water dependency in operations or supply chains, developing a water management strategy, informing internal policies, or setting reduction targets to manage costs. Depending on the objective, the scope is then defined, specifying what data will be included, such as a particular product, the entire business, or a specific timeframe (e.g., a year or a range of years).

Water Footprint Accounting: This is the calculation phase, where the amount of water used at each stage of the process, throughout the supply chain and in direct operations, is determined and summed up. This step accounts for different types of water consumption:

Blue water footprint: Represents the consumption of surface and groundwater.

Green water footprint: Refers to the consumption of rainwater, highly relevant for agriculture and horticulture.

Grey water footprint: This is a more complex element, representing the amount of clean, fresh water required to dilute pollutants to meet environmental water quality standards, not simply the direct volume of effluent discharged. This means assessing how much fresh water is needed to dilute discharged water with concentrations of elements above environmental quality standards. The analysis also includes examining the discharge of effluent, determining if it is treated according to standards.

Sustainability Assessment: Once the water footprint is quantified, this step contextualizes the data to understand its meaning for a business. It involves assessing three aspects of sustainability:

Environmental sustainability: Looking at whether water consumption has a negative impact on ecosystems or infringes on the water rights of other users from the same water source.

Economic efficiency: Evaluating if water is being used excessively to create a product that could be produced with less water while maintaining quality, often by comparing against sector benchmarks.

Social equity: Considering the social aspects of water use. This step can be challenging for businesses due to insufficient data, especially concerning visibility across the entire supply chain.

Response/Recommendation: The final step involves providing actionable recommendations based on the detailed analysis. These recommendations guide how a company can become more sustainable and effectively reduce its water footprint.

What’s Next?

We’ll likely see:

More standardized protocols for water credit verification

Integration with ESG reporting and climate-related disclosures

Localized water offset programs embedded into corporate water strategies

Public-private partnerships to scale water credit markets responsibly

Water needs its own path, one that respects its complexity, equity, and geography.

Being "water positive" could become a “license” to operate in water-stressed regions.

Follow-up

Aiming to be a business school with a growth-minded community, it is essential to follow any developments, updates, or news on how this evolves, given the relevance it will have at the corporate level while still in its early stages.

If anyone would like to contribute, share insights, or suggest someone who can help us gain a clearer understanding of how this works, please drop us a message.

I’m currently looking for a prominent Chief Sustainability Officer (CSO) to join us as a guest in the next season. The goal is to gain insights into the key aspects we should learn from this role and how it can shape our businesses. If you have any recommendations, please let me know!